Building Influencer Lists That Actually Convert

You've spent weeks building an influencer list. The follower counts look impressive. The engagement rates seem decent on paper. Then you launch your campaign—and nothing happens. Crickets. The conversions you expected never materialize.

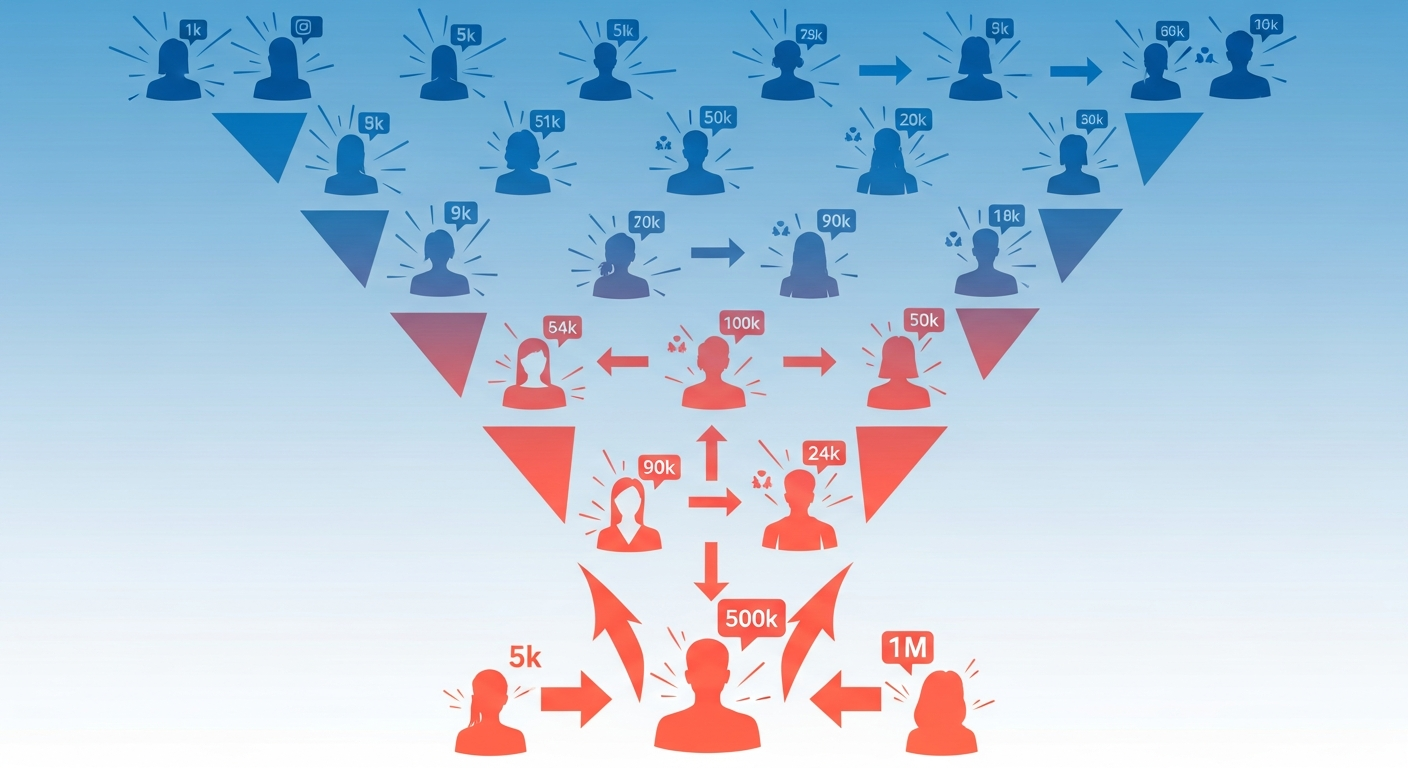

Here's the uncomfortable truth: most influencer lists are built backwards. Teams start with vanity metrics like follower counts, work down to engagement rates, and hope the audience somehow aligns with their target customers. This approach produces lists that look good in spreadsheets but fail in practice.

The influencer lists that actually drive conversions are built from the audience up, not the influencer down.

Introduction

Influencer marketing spending continues to climb, yet most marketers struggle to demonstrate clear ROI from their campaigns. The disconnect isn't with influencer marketing as a strategy—it's with how influencer lists get constructed in the first place.

The traditional approach treats influencer discovery as a numbers game: find accounts with large followings in a relevant category, filter by engagement rate, and start outreach. This method ignores the single most important factor in conversion: whether the influencer's actual audience contains your potential customers.

Building influencer lists that convert requires flipping the discovery process entirely. Instead of starting with influencers and hoping their audiences align, you start by finding where your target customers already engage, then identify which voices they trust.

Why Traditional Influencer Lists Fail

The standard influencer discovery process has three fundamental flaws that sabotage conversion before a campaign even launches.

The Vanity Metric Trap

Follower counts and engagement rates tell you almost nothing about conversion potential. An influencer with 500,000 followers and a 3% engagement rate sounds impressive—until you discover their audience is primarily teenagers in Southeast Asia while you're selling B2B software to North American enterprises.

Engagement rates are equally misleading. High engagement on lifestyle content doesn't translate to high engagement on sponsored posts. An influencer might have passionate fans who love their travel photos but scroll past anything that looks like an advertisement.

The Category Fallacy

Searching for "fitness influencers" or "tech reviewers" assumes that content category equals audience relevance. In reality, two influencers creating similar content often have radically different audiences.

Consider two tech reviewers, each with 200,000 followers. One built their audience reviewing enterprise software and attracts IT decision-makers. The other grew through gaming hardware reviews and attracts enthusiasts aged 16-24. Same category, completely different conversion potential for a SaaS company.

The Authenticity Gap

Audiences have developed sophisticated radar for inauthentic partnerships. When an influencer promotes something that doesn't match their established brand, engagement drops and conversions evaporate. The influencer's audience can tell when a partnership is forced.

This authenticity gap widens when brands select influencers based on category fit rather than genuine alignment with the influencer's existing content themes and audience interests.

The Conversion-First Framework

Building influencer lists that convert requires a fundamentally different approach: start with your target customers, discover which voices they already engage with, then evaluate those voices for partnership potential.

Step 1: Map Your Target Conversations

Before searching for influencers, identify the conversations your target customers are already having. What topics do they discuss? What questions do they ask? What content do they share?

This means searching for the specific language your customers use, not generic industry terms. A CFO looking to modernize their finance stack doesn't search for "fintech"—they're discussing "AP automation," "cash flow forecasting," or "ERP integration challenges."

Mapping these conversations reveals the actual community your customers belong to, not the category marketers assume they fit into.

Step 2: Identify Trusted Voices Within Those Conversations

Once you've mapped where your customers engage, identify which accounts consistently appear in those conversations. Who do they reply to? Whose content do they share? Which accounts spark the discussions they participate in?

These trusted voices often look different than traditional "influencers." They might have smaller followings but disproportionate influence within the specific community you're targeting. A 15,000-follower account that your target CFOs consistently engage with will outperform a 500,000-follower business account they've never heard of.

Step 3: Validate Audience Composition

Having identified potential partners through conversation mapping, the next step is validating that their broader audience—not just the segment you discovered them through—aligns with your targeting.

This means analyzing who follows them, who engages with their content regularly, and whether those users match your customer profile. An account might surface in relevant conversations but have an audience that's only 10% qualified prospects. That's still valuable information, but it affects how you structure the partnership.

Step 4: Assess Content Alignment

Conversion requires authenticity, and authenticity requires alignment between your offering and the influencer's established content themes. Review their content history to understand what topics resonate with their audience and how your brand might fit naturally.

The best partnerships feel like a natural extension of content the influencer already creates. If you have to significantly adjust their typical content style to feature your brand, conversions will suffer.

How Xpoz Addresses This

The conversion-first framework sounds logical, but executing it manually is nearly impossible at scale. Finding where your target customers engage, identifying the voices they trust, and validating audience composition across dozens of potential partners would take months of research.

This is precisely where social intelligence tools become essential. Rather than starting with influencer databases that sort by follower count, you need to start with the actual conversations happening around your target topics.

Using Xpoz, the process looks like this:

Mapping target conversations becomes practical through keyword-based user discovery. Instead of searching for "marketing influencers," you search for users who've authored content about "attribution modeling" or "demand generation metrics"—the specific topics your customers actually discuss. The getTwitterUsersByKeywords tool finds users who've created content matching these specific terms, with relevance scoring that surfaces the most active voices.

Identifying trusted voices scales through engagement analysis. When you find a post that exemplifies the conversation your customers have, you can pull everyone who commented, quoted, or retweeted it using getTwitterPostInteractingUsers. These engaged users often include other influential voices in the same community—voices you wouldn't find through traditional category searches.

Validating audience composition becomes data-driven rather than speculative. For any potential influencer, you can analyze their follower base through getTwitterUserConnections, examining the actual profiles of who follows them. Are these followers in relevant industries? Do they have decision-making authority based on their bios and positions? What's the geographic distribution?

Assessing content alignment happens through historical content analysis. Before committing to a partnership, review an influencer's entire posting history through getTwitterPostsByAuthor. You can see exactly what topics drive their highest engagement, what their sponsored content typically looks like, and whether your brand would fit naturally into their content mix.

The same framework applies to Instagram through equivalent tools. getInstagramUsersByKeywords surfaces creators based on caption content, while getInstagramPostInteractingUsers reveals who engages with relevant posts. This cross-platform analysis often uncovers influencers who are strong on one platform but undiscovered on another—opportunity zones where partnership costs are lower because competition hasn't found them yet.

Practical Examples

Example 1: B2B SaaS Looking for Thought Leaders

A project management software company wants to reach engineering managers at mid-size tech companies. Traditional approach: search for "tech influencers" or "productivity content creators."

Conversion-first approach: Search for users who've authored posts containing "sprint planning," "engineering velocity," or "technical debt management"—the actual problems their target customers discuss. This surfaces accounts that might not identify as "influencers" but who are genuine voices in the engineering leadership community. Analysis of who engages with their content reveals whether their audience contains the engineering managers the company wants to reach.

Example 2: DTC Brand Launching in a New Category

A sustainable skincare brand wants to enter the wellness space but faces hundreds of potential beauty and wellness influencers to evaluate. Traditional approach: filter beauty influencers by follower count and engagement rate.

Conversion-first approach: Find posts discussing "clean beauty ingredients," "sustainable packaging," or "cruelty-free skincare"—the specific values their target customers care about. Identify which accounts generate the most engagement on these specific topics, then analyze whether their broader follower base skews toward the demographic and psychographic profile that matches customer data.

Example 3: Financial Services Firm Reaching HNWI

A wealth management firm wants to reach high-net-worth individuals without the compliance headaches of working with registered financial influencers. Traditional approach: limited options in heavily regulated "finfluencer" space.

Conversion-first approach: Recognize that HNWI don't only consume financial content—they engage with luxury travel, fine dining, art collecting, and philanthropy content too. Search for engagement patterns around these adjacent topics, identifying influencers whose audiences overlap with the firm's target demographic without requiring financial services compliance.

Evaluating Authenticity at Scale

Beyond audience alignment, conversion requires authentic advocacy. Several signals help identify influencers likely to deliver genuine endorsements rather than hollow sponsored posts.

Content consistency over time: Analyze historical posting patterns. Accounts that frequently pivot topics or whose content style changed dramatically around the time they started taking sponsorships may have authenticity concerns. Look for consistent themes and voice across their content history.

Engagement quality, not just quantity: Raw engagement numbers matter less than who engages. An influencer whose comments come primarily from other influencers running engagement pods differs from one whose comments come from genuine community members. Analyzing commenter profiles reveals this distinction.

Sponsored content performance: Review how their audience responds to overtly promotional content. Some influencers maintain engagement even on sponsored posts because their audience trusts their recommendations. Others see dramatic engagement drops the moment a post feels commercial.

Account authenticity signals: On platforms that support it, authenticity scoring can flag accounts that may have artificially inflated metrics through purchased followers or engagement. Starting partnerships with accounts showing high authenticity scores reduces the risk of discovering inflated metrics after contracts are signed.

Building the Final List

After applying the conversion-first framework, your influencer list should include substantially different information than traditional lists:

Audience alignment score: Based on analysis of their followers and who engages with their content, what percentage genuinely matches your target customer profile?

Conversation relevance: Which specific topics from your customer conversation mapping do they actively participate in?

Content fit assessment: How naturally could your brand appear in their existing content themes?

Authenticity indicators: What signals suggest genuine influence versus manufactured metrics?

Cross-platform presence: Are they strong on multiple platforms, or concentrated on one?

This information transforms influencer selection from guesswork into evidence-based decision making. When you can demonstrate that an influencer's audience is 45% qualified prospects based on actual follower analysis, partnership ROI becomes predictable rather than hopeful.

Key Takeaways

-

Start with customers, not influencers: Build lists from conversation mapping rather than category searches. Find where your customers engage, then identify who they listen to.

-

Validate audience composition with data: Don't trust category labels or self-reported demographics. Analyze actual follower profiles to confirm audience alignment before committing to partnerships.

-

Prioritize authenticity signals over vanity metrics: Follower counts and engagement rates tell you how big an audience is, not whether they'll convert. Historical content analysis and engagement quality reveal true influence.

-

Look beyond obvious "influencers": The accounts driving highest conversion often don't identify as influencers at all. They're practitioners, experts, and community voices who happen to have trusted audiences.

-

Build evidence-based cases for partnerships: Use audience analysis to quantify expected reach to qualified prospects, transforming influencer marketing from a gamble into a measurable channel.

Conclusion

The gap between influencer lists that look good and lists that actually convert comes down to methodology. Traditional approaches optimize for the wrong metrics because they start in the wrong place.

Building influencer lists that drive conversions requires starting from your target customers and working backwards to the voices they trust. This approach demands more upfront research than pulling a list from an influencer database, but it produces partnerships that deliver measurable ROI.

The tools to execute this approach at scale now exist. Social intelligence platforms make it practical to map customer conversations, identify trusted voices, and validate audience composition across hundreds of potential partners. The brands that adopt conversion-first influencer discovery will consistently outperform those still building lists from follower counts.

Your next influencer list should answer one question: does this person's actual audience contain my potential customers? If you can't answer that with data, you're still guessing—and guessing doesn't convert.