Keyword Tracking for Market Research Success

Every day, millions of conversations unfold across social media—conversations that reveal what your customers want, what your competitors are doing, and where your market is heading. The challenge isn't finding these conversations. It's knowing which ones matter.

Introduction

Market research has fundamentally changed. Traditional methods—surveys, focus groups, quarterly reports—still have their place, but they capture sentiment at a single point in time. Meanwhile, your market evolves in real-time through social conversations that most businesses never see.

Keyword tracking bridges this gap. By systematically monitoring specific terms, phrases, and topics across social platforms, you gain continuous visibility into market dynamics. Done well, keyword tracking transforms scattered social chatter into structured intelligence that informs product decisions, competitive positioning, and go-to-market strategy.

But effective keyword tracking requires more than setting up alerts. It demands a strategic approach to what you monitor, how you structure your queries, and how you translate raw data into actionable insights.

Why Traditional Market Research Falls Short

Traditional research methods suffer from three fundamental limitations.

Timing gaps. Quarterly brand tracking studies tell you where sentiment was, not where it's going. By the time you identify a shift, your competitors may have already responded to it.

Sample bias. Survey respondents know they're being studied. This awareness changes behavior. Social conversations, by contrast, capture unfiltered opinions—people talking to their networks without a research agenda in mind.

Limited scope. Focus groups might include thirty people. A robust keyword tracking strategy captures thousands of relevant conversations daily, providing statistical significance that small samples can't match.

This isn't to say traditional methods are obsolete. They excel at structured questioning and controlled comparison. But they work best when complemented by continuous social intelligence—and that's where keyword tracking becomes essential.

Building Your Keyword Strategy

Effective keyword tracking starts with strategic query design. The goal isn't to capture everything—it's to capture what matters while filtering out noise.

Start With Your Core Terms

Begin with the obvious: your brand name, product names, and key service terms. But don't stop there. Consider:

- Common misspellings of your brand

- Abbreviations your audience uses

- Product nicknames that emerge organically

- Category terms customers search when they don't know your brand exists

A B2B software company tracking "project management" might also monitor "PM tool," "task tracker," and "team collaboration software." Each variation captures a different slice of relevant conversation.

Map Your Competitive Landscape

Your competitors' mentions are equally valuable. Track:

- Competitor brand and product names

- Their executives and spokespeople

- Terms associated with their unique positioning

- Comparison queries ("X vs Y")

Comparison conversations are particularly valuable. When someone asks their network to compare solutions, they're often in active buying mode. These conversations reveal decision criteria and objections in ways that surveys rarely capture.

Define Your Topic Universe

Beyond brands, define the broader topics that matter to your business. A cybersecurity company might track:

- Threat types: "ransomware," "phishing," "data breach"

- Regulatory terms: "GDPR compliance," "SOC 2"

- Industry events: specific conference hashtags, regulation names

- Emerging concerns: new attack vectors, vulnerability disclosures

This topic universe forms the context in which your brand operates. Monitoring it helps you understand market evolution even when conversations don't mention you directly.

Use Boolean Logic Strategically

Simple keyword lists generate noise. Boolean operators transform them into precision instruments.

Exact phrase matching ensures you capture specific concepts, not stray word combinations. Searching for "machine learning" (with quotes) returns posts about the technology, not scattered mentions of "machine" and "learning" in unrelated contexts.

OR operators expand reach when multiple terms describe the same concept. A query like "customer experience" OR "CX" OR "user experience" captures conversation across terminology variations.

AND operators narrow focus when you need intersection. "sustainable packaging" AND "food industry" filters out sustainable packaging discussions in other verticals.

NOT operators exclude irrelevant contexts. A bank tracking "interest rates" might exclude mentions of "interesting" with "interest rates" NOT "interesting"—though use exclusions carefully to avoid filtering out legitimate results.

Complex queries combine these elements: ("customer churn" OR "customer retention") AND (SaaS OR "software company") NOT "case study" targets organic discussion while filtering out promotional content.

Structuring Your Monitoring Framework

With your keywords defined, structure them into a monitoring framework that supports different research objectives.

Tiered Monitoring

Not all keywords deserve equal attention. Structure them into tiers:

Tier 1: Real-time alerts. Your brand name, crisis-related terms, and key competitive mentions. These warrant immediate visibility.

Tier 2: Daily review. Broader competitive landscape, industry trends, and category conversations. Review daily or weekly depending on volume.

Tier 3: Periodic analysis. Long-tail topics, emerging terms, and experimental queries. Analyze monthly or quarterly to spot patterns.

This tiered approach prevents alert fatigue while ensuring critical conversations don't slip through.

Volume Tracking Over Time

Raw conversation counts, tracked consistently, reveal market dynamics. A sudden spike in mentions of a competitor's product name might signal a launch, a crisis, or a viral moment worth understanding.

Volume trends also reveal market interest in problems you solve. If conversations about "remote team management" increase 40% quarter-over-quarter, that signals growing demand in your category—useful context for positioning and content strategy.

Sentiment as a Directional Signal

Automated sentiment analysis isn't perfect, but directional signals still prove valuable. A shift from predominantly neutral to increasingly negative mentions of a competitor suggests an opportunity. Sustained positive sentiment around an emerging topic suggests genuine enthusiasm rather than passing interest.

Treat sentiment as one input among many, not a definitive measure. Combine it with manual review of high-engagement posts to understand the "why" behind the numbers.

Common Keyword Tracking Mistakes

Even well-intentioned monitoring efforts can go wrong. Avoid these common pitfalls.

Tracking Too Broadly

Monitoring "innovation" or "digital transformation" generates overwhelming volume with minimal signal. Broad terms attract so much conversation that meaningful patterns get buried. Instead, pair broad terms with qualifiers: "digital transformation" AND "retail" or "innovation" AND "supply chain".

Ignoring Context Shifts

Keywords mean different things in different contexts. "Cloud" means something specific in technology but something entirely different in weather discussions. Regularly audit your results to ensure you're capturing relevant conversations, not just volume.

Set and Forget Syndrome

Markets evolve. New competitors emerge. Terminology shifts. A keyword strategy that worked last year may miss critical conversations today. Schedule quarterly reviews of your monitoring framework to add emerging terms and retire obsolete ones.

Missing Conversation Threads

A viral post might generate thousands of replies and quote posts—each containing valuable sentiment and perspective. Tracking only original posts misses the discussion they spark. Effective monitoring captures comments, quotes, and retweets to understand full conversation dynamics.

How Xpoz Addresses This

Implementing keyword tracking at scale requires infrastructure that most teams lack. Building and maintaining social data pipelines, managing API rate limits, structuring data for analysis—these technical challenges can consume months of engineering time.

Xpoz eliminates this infrastructure burden. As a remote MCP server, it provides immediate access to social intelligence across Twitter and Instagram without API key management or data pipeline construction.

The getTwitterPostsByKeywords tool accepts full boolean query syntax—exact phrases, AND/OR operators, exclusions—returning structured results ready for analysis. Fields like engagement metrics, timestamps, and author information come standard, enabling immediate segmentation and trend analysis.

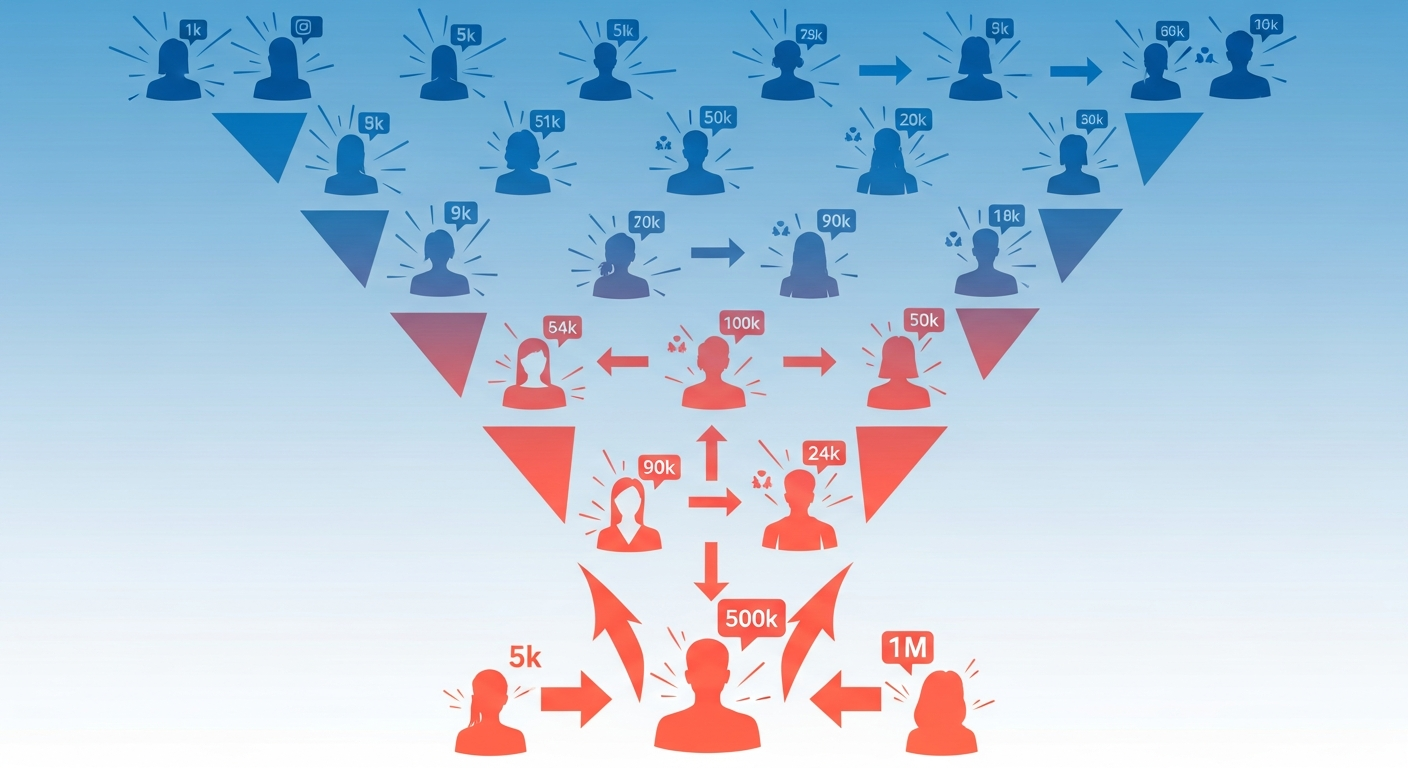

For competitive intelligence, getTwitterUsersByKeywords identifies who's driving conversations around specific topics. The relevantTweetsCount and relevantTweetsLikesSum aggregation fields help prioritize voices by both volume and influence—useful for identifying which analysts or influencers shape narrative around your category.

Volume tracking becomes straightforward with countTweets, which returns mention counts for specific phrases across custom date ranges. Run this monthly against your core terms to build the trend data that reveals market momentum.

When a conversation warrants deeper analysis, getTwitterPostComments and getTwitterPostQuotes retrieve the full discussion thread. This matters because high-engagement posts often spark nuanced debate in replies that initial metrics don't capture.

For teams needing offline analysis, every query can export complete datasets as CSV files. This supports statistical analysis, visualization, and integration with existing market research workflows—no additional data engineering required.

Practical Examples

Consider how keyword tracking supports specific market research objectives.

Example 1: Category Demand Analysis

A project management software company wants to understand whether remote work is driving sustained demand or returning to pre-pandemic baseline.

They configure tracking for: "remote team" OR "distributed team" OR "hybrid work" combined with "project management" OR "task management" OR "team collaboration".

Monthly volume analysis over twelve months reveals that conversation isn't declining—it's shifting. "Hybrid work" mentions now exceed "remote work" mentions by 2:1, and associated discussion increasingly focuses on "async communication" and "documentation."

This signals a positioning opportunity: emphasize asynchronous collaboration features rather than generic "remote work" messaging. The insight emerged from keyword tracking that surveys likely wouldn't reveal—few respondents would articulate this preference unprompted.

Example 2: Competitive Intelligence

A cybersecurity vendor notices increasing mentions of a new competitor. Rather than reacting to anecdote, they structure systematic tracking.

They monitor the competitor's brand name, product names, and executives. They analyze getTwitterPostsByKeywords results to categorize mentions: product announcements, customer sentiment, analyst commentary, job postings.

Several patterns emerge. The competitor's mentions spike around industry conferences, suggesting heavy event investment. Sentiment skews positive among practitioners but neutral among analysts—potentially indicating a perception gap worth exploiting. Job postings emphasize "enterprise sales," signaling their market focus.

This intelligence informs competitive positioning, sales battle cards, and event strategy—all derived from structured keyword tracking rather than ad-hoc observation.

Example 3: Trend Validation

A food and beverage brand sees "adaptogenic" appearing in trade publications. Before investing in product development, they want to validate whether consumer interest exists or whether it's industry echo chamber.

They track: "adaptogenic" OR "adaptogens" alongside related terms like "functional beverage" AND "stress relief".

Analysis reveals that conversation volume is real but concentrated among a specific audience: wellness-focused accounts with certain demographic and engagement patterns. getTwitterUsersByKeywords helps profile who's driving conversation—predominantly younger consumers in urban markets.

The insight isn't "launch an adaptogenic product." It's "there's genuine interest among a specific segment in specific markets." That precision enables a targeted test launch rather than broad rollout, reducing risk while validating the opportunity.

Key Takeaways

-

Structure keywords strategically. Boolean operators transform broad monitoring into precise intelligence. Invest time in query design to maximize signal and minimize noise.

-

Tier your monitoring. Not every keyword needs real-time attention. Structure frameworks that match monitoring intensity to business impact.

-

Track volume over time. Conversation counts, trended consistently, reveal market dynamics that point-in-time research misses.

-

Capture full conversations. Original posts matter, but replies and quotes often contain the richest insight. Monitor discussion threads, not just initial mentions.

-

Review and evolve. Markets change. Terminology shifts. Schedule regular audits of your keyword strategy to ensure continued relevance.

Conclusion

Keyword tracking isn't a passive activity—it's an ongoing discipline that rewards strategic investment. The companies that excel at market research in the next decade will be those that combine traditional methods with continuous social intelligence, using keyword tracking to maintain real-time visibility into market conversations.

Start with your core terms. Expand methodically into competitive and category tracking. Structure results into actionable frameworks. And choose tools that reduce infrastructure burden so you can focus on insight rather than data engineering.

The conversations that matter to your business are happening now. The question is whether you're positioned to hear them.